Instant PAN Card Through Aadhaar

You can get the instant e-PAN for free in just 10 minutes in a soft copy format. If you doubt that the e-PAN can work for all services here is the answer the e-PAN is identical like the PAN you get after filling the detailed application form.

Every person know that PAN card is required in various fields like paying income tax, filing income tax returns (ITR), opening a bank or demat account, debit or credit card. In all these service you can use e-PAN.

Instant PAN Allotment Through Aadhaar

The new allocation facilitates the allotment of Instant PAN to individuals who have a verified Adhaar Card. The applicant doe not have to submit the long detailed application form. The card will be issued in PDF format with no additional charges.

The PDF contains a QR code that gives enumeration such as the applicant’s name, date of birth, and photographs. You can also use a 15-digit acknowledgement number to download the e-PAN from income tax online portal. The soft copy will be sent to your registered email address.

Not only one website works for this service you can also use NSDL and UTITSL websites and have to pay some charges. Applying for PAN through this method automatically links the Aadhaar with your pan.

Requirements of Instant PAN Facility

The most necessary requisites for the instant PAN through Aadhaar-based e-KYC:

a. The applicant must have a verified Aadhaar number and it should not be linked with any PAN before.

b. The applicant's registered mobile number should be linked with the Aadhaar.

c. As it is a paperless process there is no need to submit any type of KYC documents.

d.Applicants should not hold more than one PAN if one have more than one valid PAN then he will be inflicted to pay the penalty under Section 272B(1) of the Income Tax Act, 1961.

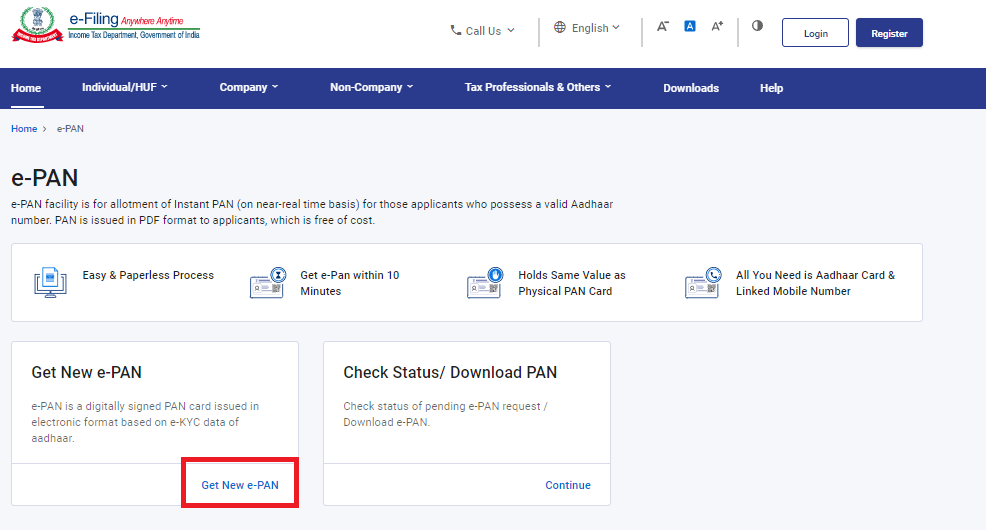

Step 1: Firstly visit the official website (www.incometax.gov.in) and go to the homepage.

Step 2: On top menu you will see 'Quick Links' section on clicking a drop down menu will appear select 'Instant E-PAN' it will redirect you to new page.

Step 4: For PAN allotment enter the Aadhaar number and click on ‘I confirm that’ to confirm and then ‘Continue’.

Step 5: To verify the Aadhaar details provided by you an OTP will be sent to your registered mobile number then click on ‘Validate Aadhaar OTP and Continue’ as you consent to validate the details.

Step 6: So on the next page you have to enter the OTP you received where you have to tick checkbox to accept the terms and conditions and click on Continue button.

Step 7: Enter the OTP.

Step 8: IF you E-mail ID is not verified then click on Validate email ID select the checkbox and Continue.

Once you submit all the details required for validation yo will be given an acknowledgement number. You can check the status of PAN allotment by entering thwe Aadhaar number.This process will not take much time.