Profits of paying credit card bill through

CRED

APP

1. Credit Card Payments

You can add all the credit cards you have in the app, track the payment due

dates and pay the bills straightaway from the app.

You don’t have to verify your credit card statement every month

individually. For payments you can also use other net-banking or UPI apps.

The entire process of payments is very fleet and smooth.

2. Cashback on Paying Bills

You will get cashback on your bill payment transaction. In a drop down menu you will see “killthebill” after the payment is done. It works similar to scratch card, where you can win rewards up to 1000. Some lucky customers actually earned 1000Rs cashback.

Generally you can use 5 scratch cards of cashback worth Rs 1000 in a datebook.

You can earn scratch cards on large payments:

|

On Payment |

Earn Up to |

|

Rs

50,000 |

1,00,000 |

|

Rs

20,000 |

10,000 |

|

Rs

5,000 |

5,000 |

But actually you can only expect a small cashback from these scratch

cards, like between Rs 20 from the 5000 scratch card.

3. Earn CRED coins to redeem gifts

You get as equal CRED coins the

amount of payment you do, such as you do a payment of Rs.1000 you get 1000 cred

coins. You can use the CRED points to get discount coupons of brands. These

offers change on regular basis.

If you refer the app to your friend then You and your friend would get Rs 1000 cashback on their first bill

payment.

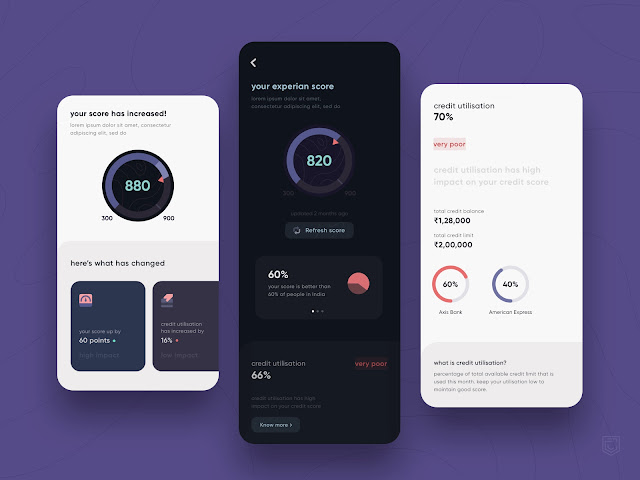

You can verify your CIBIL score and past credit free of cost. At the

moment app shows the credit numbers from outlook of Experian and CRIF.

First Credit Report is free then you can check your latest score by spending 1000 CRED points.

Best Use of the

CRED App

·

You can install it from ios and android

·

You would be permitted only if you have a up to the mark CIBIL score

·

App starts with your registered mobile number

·

Your application may get denied if your mobile number details doesn’t

verify with the CIBIL report.

If approved,

·

Add details of credit card in the app.

·

The app procedure will verify your credit cards by depositing Rs. 1 into

your card.

·

Job done now pay your credit card bills.

If rejected,

·

Check the contact details if you use several mobile numbers for banking

·

Use customer service if you are sure of your information.

·

Wait & Apply after some time periopd if your credit score is not

good.